Introduction

The U.S. government shutdown began on 1 October 2025 and is still ongoing, with no clear end in sight. If you are buying a home, refinancing, or simply trying to make sense of mortgage rates, this uncertainty can leave you feeling stuck. Headlines are mixed — some suggest rates are falling, others warn of processing delays and market instability. It is hard to know what to believe, let alone what to do next. The reality is that during a prolonged shutdown, pressure builds across the mortgage industry, creating ripple effects for everyday buyers and homeowners. At ERLIPRO, we understand how overwhelming this can feel. That is why we focus on cutting through the noise, helping you understand what matters, and giving you the clarity you need to make confident, informed decisions.

Mortgage Rates During Shutdowns: Why They’re So Hard to Predict

You might expect mortgage rates to either rise sharply or drop significantly during a government shutdown, but the reality is far more complex. Rates are closely tied to investor expectations about the economy. When uncertainty increases, as it often does during a shutdown, investors tend to shift their money into safer assets like U.S. Treasury bonds. This typically drives bond yields down, which can lead to lower mortgage rates. That is the theory, but in practice, it rarely plays out so cleanly.

One of the main reasons is the sudden freeze in government-issued economic data. Key reports on employment, inflation, and consumer activity are paused, leaving investors and the Federal Reserve without the information they need to make informed decisions. This lack of clarity fuels market speculation rather than fact-based movement. Lenders may become more cautious, building extra margin into their rates, while others react to short-term shifts in the bond market. The result is volatility and inconsistency. With this current shutdown happening in an already high-rate environment, lenders are even more hesitant. Without reliable data, they are likely to keep pricing conservative. In the end, shutdowns rarely drive rates in one clear direction. What they do is introduce uncertainty, and in the mortgage world, uncertainty leads to hesitation.

Loan Processing Delays: What Borrowers Need to Watch Out For

While mortgage rates tend to dominate the headlines during a government shutdown, the bigger issue for many borrowers is the disruption to the loan process itself. Several federal agencies that support mortgage approvals are either closed or operating with reduced staff, which is causing noticeable slowdowns. This is especially affecting government-backed loans like FHA, VA, and USDA. Income verification through the IRS is taking longer, FHA and VA services are moving more slowly, and USDA loans may be paused entirely. On top of that, some lenders rely on federal databases to verify Social Security numbers and employment history, which may not be accessible during the shutdown.

If you are already under contract, these delays could push back your closing date. If you are still searching for a home or planning to refinance, it is important to build in extra time and stay closely connected with your lender. The best way to stay ahead is to be proactive, keep your documents in order, and respond quickly to any requests. Things may not move as fast as usual, but being prepared can help you avoid unnecessary setbacks.

Lessons from Past Shutdowns and How They Compare to 2025

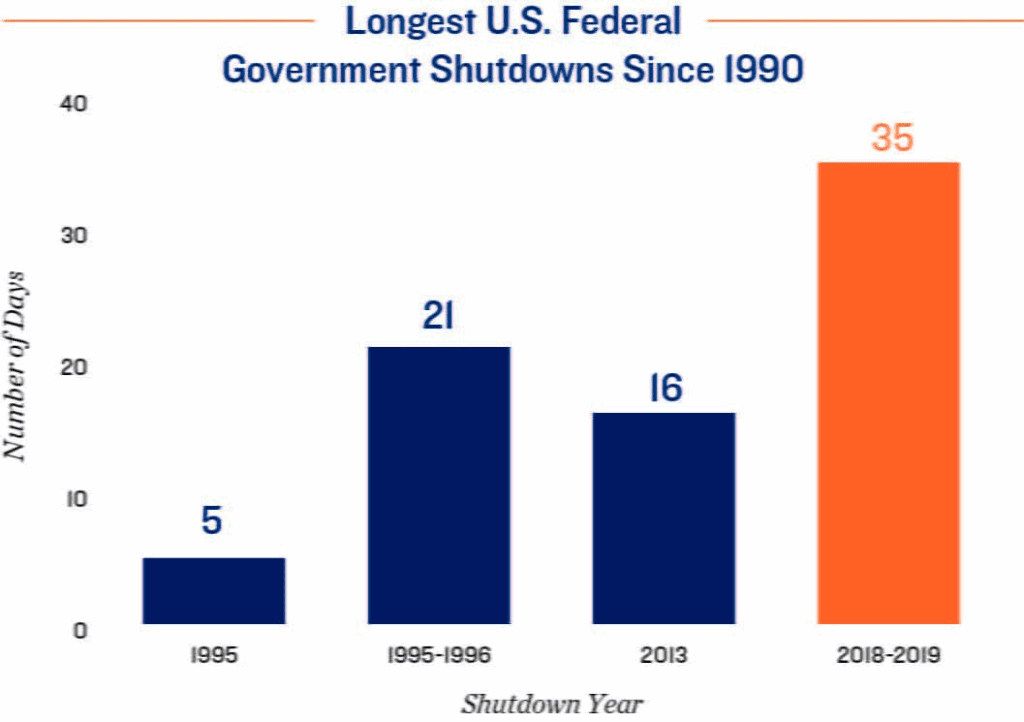

This is not the first time the government has shut down, and while every situation is a little different, looking at past shutdowns can help us understand what might happen now. In 2013, the shutdown lasted 16 days and led to delays in IRS transcript processing and FHA endorsements. Loan timelines were extended, but mortgage rates stayed relatively stable. The 2018 to 2019 shutdown lasted 35 days and had a wider impact. Borrowers using FHA, VA, and USDA loans saw more significant delays, the IRS operated with extremely limited capacity, and some home purchases were postponed. Interestingly, mortgage rates actually dipped slightly during that time due to increased demand for bonds and broader market caution. These examples show that shutdowns rarely trigger sharp rate increases. Instead, they create uncertainty, which slows down the lending process and causes short-term volatility. The 2025 shutdown feels much like 2018 in both length and disruption. Economic data is on hold, federal agencies are stretched thin, and there is no clear end in sight. The key difference today is that we are already in a high-rate environment, so even small movements feel more significant. If the shutdown drags on, delays will likely grow and rate volatility may continue. But as with previous shutdowns, stability tends to return once the government reopens and the flow of data resumes.

Should You Lock Your Rate or Wait?

With so much uncertainty in the market, many people are asking whether they should lock in their mortgage rate now or wait. The answer depends on your situation, risk tolerance, and timeline. Locking your rate may be the better choice if you are under contract, already have verified financials, prefer predictability, or want to avoid the risk of rates rising further. On the other hand, waiting could make sense if you are still house hunting, your application is not yet submitted, you believe rates might drop after the shutdown ends, or you have flexibility around your timeline. In unpredictable markets like this, locking can provide peace of mind, while floating gives you a chance to catch lower rates if you are comfortable with the risk. The most important thing is to stay in close contact with your lender or mortgage advisor, understand your rate lock options, and make a choice that aligns with your financial goals and comfort level.

How Erlipro Can Help You Navigate the Uncertainty

At ERLIPRO, we help you cut through the noise and make smart decisions, even in times like this. Whether you are buying, selling, investing, or refinancing, our expert guidance keeps you informed and in control. We track market changes in real time, explain how they affect your situation, and give you practical tools to take action with confidence. If delays or rate swings are making you second-guess your next move, we are here to help you plan, prepare, and stay one step ahead. This shutdown may feel like everything is on pause, but your goals do not have to be. Reach out to ERLIPRO and let us help you move forward with clarity.